#Fibonacci pullback

Explore tagged Tumblr posts

Text

ETC and BCH Demonstrate Strength in the Face of Cryptocurrency Market Fluctuations

ETC’s surge above $30 signifies investor confidence, marking sustained growth within an upward trend channel. Amid Bitcoin’s downturn, BCH demonstrates resilience, charting a robust bullish path within an expanding channel. Identifying key Fibonacci pullback or support levels provides clear benchmarks for potential gains in Bitcoin Cash. In the ever-changing cryptocurrency market, Ethereum Classic (ETC) and Bitcoin Cash (BCH) have stood out as notable performers, each navigating market fluctuations with distinctive strengths. ETC's recent breakthrough above the $30 resistance level has fueled optimism, solidifying its position in a persistent upward trend channel. Meanwhile, BCH has showcased remarkable resilience, carving a strong bullish trajectory within an expanding channel despite Bitcoin's bearish undertones.

Ethereum Classic (ETC) has demonstrated sturdy growth, maintaining a steady climb within an ascending trend channel, signaling heightened investor confidence. The cryptocurrency recorded a 4.65% increase in the last 24 hours, closing at $29.54, with a market cap of $4,283,895,306, securing its rank at #21 in the market.

Technical analysis points to a positive signal from a rectangle formation, with a decisive break above the $30 resistance level. This breakout not only instilled confidence among investors but also suggested a continued upward path. ETC's resilience in the face of market volatility is highlighted by its 53.81% volume-to-market cap ratio, reflecting a healthy trading environment.

Turning our focus to Bitcoin Cash (BCH), the cryptocurrency witnessed an impressive 15.25% surge in the past 24 hours, closing at $292.25. This surge propelled BCH to the 18th position in market rankings, boasting a market cap of $5,731,492,869. BCH’s trading volume experienced a substantial increase, reaching $837,906,681, resulting in a volume-to-market cap ratio of 130.27%.

Technical indicators for Bitcoin Cash indicate a robust bullish momentum characterized by an upward expansion of channels. Notably, while Bitcoin (BTC) faced bearish trends, BCH exhibited resilience and emerged as a symbol of bullish sentiment. Investors were advised to approach cautiously, considering the late entry point into the bullish trend.

Waiting for a minor pullback at Fibonacci points or identifying support levels is a prudent strategy to manage risks. The target for BCH remained at the channel’s upper resistance or the previous high, providing investors with clear benchmarks for potential gains.

In summary, both Ethereum Classic and Bitcoin Cash delivered commendable performances, navigating the volatile crypto market with distinct strengths. Ethereum Classic's positive signal from breaking above $30 and its sustained upward trend channel indicated positive sentiment among investors. On the other hand, Bitcoin Cash's robust bullish momentum within an expanding channel underscored its resilience amid broader market challenges. As the cryptocurrency landscape evolves, these developments offer valuable insights for investors seeking strategic opportunities in the digital asset space.

#Ethereum Classic#ETC#Bitcoin Cash#BCH#cryptocurrency market#market volatility#investor confidence#upward trend channel#breakout#resistance level#bullish momentum#technical analysis#Fibonacci pullback#cryptotale

0 notes

Text

How to Trade the Breakout & Retest Pattern: Strategies That Work

Breakout and retest trading is one of the most reliable techniques in technical analysis. It allows traders to enter trades with confidence after confirming the breakout of a key support or resistance level. If executed correctly, it offers high probability entries, clear invalidation points, and strong risk-to-reward ratios. In this blog, we’ll break down everything you need to know about the…

#breakout and pullback strategy#breakout and retest confirmation#breakout and retest pattern#breakout and retest trading strategy#breakout continuation pattern#breakout entry strategy#breakout retest candlestick pattern#breakout reversal signals#breakout trading risk management#breakout trading strategy for beginners#breakout vs breakdown#chart patterns with breakout#Confluence Trading#failed breakout recovery#fake breakout vs real breakout#Fibonacci breakout confluence#high probability breakout setup#how to identify breakout levels#how to trade breakout and retest#intraday breakout and retest setup#key support and resistance zones#learn technical analysis#Price Action Trading#retest after breakout#retest in technical analysis#stock markets#stock trading#successful trading#support and resistance breakout#swing trading breakout strategy

0 notes

Text

EUR/USD Poised for Lift-Off: Is Wave ⑤ Now Underway?

▪️Elliott Wave analysis on the daily chart of EUR/USD shows that corrective wave (iv) has likely completed at the 38.2% retracement of wave (iii), suggesting the beginning of a bullish wave (v) targeting the 1.17 level and beyond.

▫️On the 4-hour chart, the completion of a WXY corrective structure (wave iv in green) is evident, followed by a clear impulse wave (i) and a potential shallow pullback in wave (ii), which appears near completion.

▪️The expected scenario favors the start of a new impulsive rally, supported by clean wave structure and Fibonacci symmetry.

▫️As long as 1.1065 holds, the bullish outlook remains valid, with a breakout above 1.1380 strengthening the case for a move toward 1.17+.

#forex#forextrader#elliottwave#bitcoin#investing#eurusd#cryptocurrency#elliott wave theory#business#gold

3 notes

·

View notes

Text

Will The Rally In GDX And SILJ Continue Or Consolidate?

Where has the time gone? Chris is sitting down with Craig Hemke at Sprott Money to talk about all things markets and precious metals.

Our discussion covered the following topics and questions:

What do you see on the equities charts? Is NVIDIA solely responsible for the markets continuing their climb?

What is the Bitcoin chart pointing to?

How do you manage the emotion of wanting to take the opposite side of a big move?

In one week, Gold and GDX have rocketed higher; is this a one-time pop, or will they continue to move higher?

Are pauses and pullbacks a good sign? Why is the .618 level so important in Fibonacci?

What do you see happening for silver?

What are some levels to watch for if people want to get into a GDX trade?

Watch The Interview Here

2 notes

·

View notes

Text

what are the best indicators for forex trading

Best Indicators for Forex Trading – Ultimate Guide (Overview)

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

Telegram Channel

1. Moving Averages (MA)

Moving Averages are among the most widely used indicators for identifying the direction of the trend.

Simple Moving Average (SMA): Smooths out price data over a period.

Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive.

Best use cases:

Spotting trend direction.

Entry/exit points when combined with crossover strategies (e.g., 50 EMA and 200 EMA golden/death cross).

2. Relative Strength Index (RSI)

RSI measures the speed and change of price movements on a scale of 0 to 100.

Overbought: Above 70

Oversold: Below 30

Best use cases:

Identify potential reversals.

Confirm trend strength in combination with price action.

3. Moving Average Convergence Divergence (MACD)

MACD is a momentum-following indicator showing the relationship between two EMAs.

Components: MACD line, Signal line, Histogram

Crossovers and divergences signal trade opportunities.

Best use cases:

Confirm trend direction.

Identify momentum changes.

4. Bollinger Bands

Created by John Bollinger, this indicator consists of a moving average with upper and lower bands set 2 standard deviations away.

Best use cases:

Measure volatility.

Identify potential breakout or reversal areas when price hits the outer bands.

5. Stochastic Oscillator

A momentum indicator comparing a particular closing price to a range of its prices over time.

Readings above 80 indicate overbought conditions.

Below 20 indicates oversold.

Best use cases:

Pinpoint entry points.

Effective in ranging markets.

6. Fibonacci Retracement

Used to identify potential support and resistance levels based on Fibonacci ratios (38.2%, 50%, 61.8%).

Best use cases:

Predict pullback levels.

Combine with trend indicators for optimal entries.

7. Ichimoku Cloud

A comprehensive indicator that shows support/resistance, trend direction, and momentum.

Key components: Kumo (cloud), Tenkan-sen, Kijun-sen, Chikou Span.

Complex but powerful once mastered.

Best use cases:

Full-market overview.

Effective in trending markets.

8. Average True Range (ATR)

Measures market volatility over a period.

Best use cases:

Set stop-loss and take-profit levels.

Identify volatile market conditions.

9. Volume Indicators (On-Balance Volume – OBV)

While Forex is decentralized, tick volume or broker volume helps gauge momentum.

Best use cases:

Confirm breakouts.

Validate trend strength.

10. Parabolic SAR

Used to determine the direction of an asset’s momentum and potential reversal points.

Best use cases:

Effective for trailing stop losses.

Best used in trending markets (not ranging).

Combining Indicators for Best Results

RSI + Moving Average: Confirm reversals in trend direction.

MACD + Bollinger Bands: Catch momentum in volatile periods.

Fibonacci + EMA: Plan entries on pullbacks during strong trends.

Tips for Indicator Use

Don’t rely on a single indicator.

Backtest your indicator strategy.

Use indicators with your trading style (scalping, day trading, swing trading).

Keep your chart clean – 2–3 indicators maximum.

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

#forex#forex market#forex education#forex news#forex online trading#forex ea#forex factory#forex broker#crypto#forex indicators

0 notes

Text

Top Swing Trading Strategies That Actually Work

Master the Market with Proven Techniques Backed by Real Experience

Understanding the Power of Swing Trading

In the fast-paced world of forex and financial markets, swing trading stands out as one of the most effective strategies for capturing short- to medium-term gains. Unlike day trading, which requires constant screen time, or long-term investing that demands immense patience, swing trading offers a balanced approach—allowing traders to capitalize on price movements that occur over several days or weeks.

But success in swing trading doesn’t come from guesswork. It requires discipline, a solid plan, and the right tools. In this guide, we break down top swing trading strategies that actually work, supported by expert insight and a real-life success story from a trader who turned knowledge into profit.

What Is Swing Trading?

Swing trading is a trading style that focuses on capturing price “swings” within a trend. Traders use a mix of technical and fundamental analysis to enter positions during corrective phases or breakouts and aim to hold them from a few days to a few weeks. This approach allows for flexibility and reduces exposure to overnight market risks compared to day trading.

This strategy is particularly well-suited for forex traders who want consistent returns without the high-pressure demands of intraday trading.

Top Swing Trading Strategies That Deliver Results

1. Trend Following Strategy

This strategy focuses on identifying and trading in the direction of a well-established trend. Swing traders using this technique look for retracements in an uptrend or downtrend and enter trades at key support or resistance levels.

Key Indicators:

Moving Averages (50-day and 200-day)

MACD (Moving Average Convergence Divergence)

Trendlines

Why It Works: Markets tend to move in trends, and riding the momentum increases the probability of success. By entering during pullbacks, traders gain a better risk-reward ratio.

2. Breakout Trading

Breakouts occur when the price moves beyond a well-established support or resistance level with increased volume. Swing traders seek to enter at the beginning of the breakout and ride the wave until the momentum slows.

Key Tools:

Volume Indicators

Bollinger Bands

Price Channels

Pro Tip: Always confirm breakouts with volume spikes to avoid false breakouts.

Click Now

3. Fibonacci Retracement Strategy

Fibonacci retracement levels are used to predict potential reversal zones during market pullbacks. Swing traders often combine Fibonacci levels with other indicators to time their entries and exits.

Common Levels: 38.2%, 50%, and 61.8% Best Used With: RSI (Relative Strength Index) or candlestick patterns

This strategy works especially well in trending markets, where traders aim to enter at the retracement and exit near the previous swing high or low.

4. Support and Resistance Trading

Trading based on horizontal support and resistance levels is a classic swing trading approach. When the price approaches a significant level, traders anticipate either a bounce or a breakout.

Tools for Identification:

Price action analysis

Historical chart data

Advantage: This method offers clear entry and exit points, reducing guesswork.

5. Moving Average Crossover Strategy

This strategy involves using two different moving averages—typically a short-term and a long-term one. When the short-term MA crosses above the long-term MA, it generates a buy signal, and vice versa for sell signals.

Common Pairings:

10-day and 50-day

20-day and 100-day

Benefit: This system is straightforward and effective for spotting trend changes early.

Real-Life Trader Success Story: How Sarah Mastered Swing Trading

Sarah Henderson, a 34-year-old marketing executive from the UK, ventured into forex trading as a side hustle. Initially overwhelmed by market volatility, she sought a method that suited her busy schedule. That’s when she discovered swing trading.

Sarah opened an account with FP Markets, drawn by their tight spreads and access to advanced charting tools. She focused on swing trading strategies—particularly trend-following and Fibonacci retracements. Using their MetaTrader 4 platform, she was able to backtest her strategies and identify profitable setups.

Within her first year, Sarah achieved a 27% return on her trading capital. Her most successful trade came during a GBP/USD rally, where she entered on a retracement at the 50% Fibonacci level and exited after a 250-pip move. “The key was not trading every day, but making every trade count,” Sarah shares.

Today, she continues to swing trade part-time while educating new traders through her blog, attributing her success to a disciplined strategy and the right broker.

Why Choosing the Right Broker Matters?

No matter how good your strategy is, a poor brokerage platform can derail your success. Swing traders require:

Fast trade execution

Low spreads and commissions

Reliable charting tools

Strong customer support

Trustworthy regulation

FP Markets ticks all these boxes. With access to MT4/MT5, ultra-low latency execution, and multi-regulated oversight, they are a top choice for serious forex swing traders.

FAQs – FP Markets & Forex Swing Trading

1. Is FP Markets good for swing trading? Yes, FP Markets offers competitive spreads, advanced charting platforms, and excellent execution speeds—making it ideal for swing trading.

2. What trading platforms does FP Markets offer? FP Markets supports MetaTrader 4, MetaTrader 5, and Iress. For swing traders, MT4 and MT5 provide a wide range of tools for technical analysis.

3. Does FP Markets allow holding positions overnight? Absolutely. FP Markets supports overnight positions, which is essential for swing trading. Just be mindful of swap/rollover fees depending on the instrument.

4. How can I manage risk while swing trading with FP Markets? Use proper stop-loss and take-profit orders, apply sound risk management (e.g., risking only 1-2% per trade), and backtest strategies on FP Markets’ demo accounts before going live.

5. Is FP Markets regulated and secure? Yes, FP Markets is regulated by ASIC (Australia), CySEC (Europe), and other financial authorities. This multi-jurisdictional regulation enhances trader security and transparency.

youtube

Final Thoughts: Swing Trading as a Path to Financial Freedom

Swing trading isn't just a strategy—it’s a mindset. With the right approach, tools, and broker, traders can systematically profit from the natural ebb and flow of market prices. Whether you're just starting or refining your edge, the strategies shared above are time-tested and battle-proven.

Platforms like FP Markets give you the foundation you need, but your discipline, patience, and education will ultimately determine your success. Take inspiration from traders like Sarah, and remember—mastering swing trading starts with understanding the market and respecting your plan.

Learn More

0 notes

Text

Top Strategies for Successfully Trading Breakouts and Pullbacks

Trading breakouts and pullbacks are two of the most powerful strategies in technical analysis. When executed correctly, they can offer high-probability setups and consistent returns. At AtlasFunded, we help traders sharpen their edge by understanding market structure, timing, and risk management. In this guide, we’ll break down the top strategies for successfully trading breakouts and pullbacks.

What Are Breakouts and Pullbacks?

A breakout occurs when the price moves beyond a defined support or resistance level with increased volume. This often signals the start of a new trend. A pullback, on the other hand, is a temporary reversal within an existing trend—a chance for traders to enter at a better price before the trend resumes.

Both strategies are used by day traders, swing traders, and even long-term investors.

Strategy 1: Identify Key Support and Resistance Levels

The foundation of breakout and pullback trading lies in accurately identifying support and resistance zones. These levels are where price has historically reversed or paused, making them critical decision points.

Tip: Use tools like horizontal lines, Fibonacci retracements, and pivot points to mark these areas. Volume analysis can also confirm the strength of a breakout.

Strategy 2: Use Volume to Confirm Breakouts

Volume plays a crucial role in confirming the validity of a breakout. A breakout with high volume indicates strong market interest and a higher chance of follow-through.

AtlasFunded Insight: Low-volume breakouts are more likely to fail or reverse, trapping traders in poor entries. Always wait for volume confirmation before jumping in.

Strategy 3: Wait for the Retest (Breakout-Pullback Combo)

One of the most effective breakout trading methods is to wait for the retest. After the initial breakout, price often returns to test the previous resistance (now support) or support (now resistance) before continuing.

This gives traders a chance to enter with a lower risk and higher reward setup.

Strategy 4: Trendline and Moving Average Pullbacks

When trading pullbacks, using a trendline or moving average (like the 20 EMA) helps identify dynamic support or resistance. These indicators can act as reliable zones for pullback entries during a trend.

Tip: Enter on a bullish or bearish candlestick pattern near the trendline or moving average for added confirmation.

Strategy 5: Set Clear Entry, Stop, and Target Levels

Whether trading a breakout or pullback, never skip proper risk management. Define:

Entry: Above the breakout point or at the pullback support/resistance

Stop-loss: Below the breakout level or under recent swing low/high

Take-profit: Based on risk/reward ratio (e.g., 1:2 or 1:3)

At AtlasFunded, we emphasize disciplined trade planning to help traders scale with confidence.

Conclusion

Trading breakouts and pullbacks can be incredibly rewarding, but success comes from preparation, not prediction. Focus on structure, confirmation, and discipline.

Join AtlasFunded and gain access to educational resources, funding opportunities, and a community that empowers you to trade smarter, not harder.

0 notes

Text

Position Trading in the Cryptocurrency Market

Introduction

Position trading is a long-term trading strategy that involves holding assets for extended periods—often weeks or months—to capture large market trends. In contrast to day trading or scalping, position traders are less concerned with short-term price movements and more focused on fundamental analysis and macroeconomic trends that shape the broader market.

What Is Position Trading?

This strategy aims to benefit from sustained price movements over time. Position traders identify strong directional trends and enter trades based on analysis of long-term patterns. It is particularly suitable for cryptocurrencies, which often experience powerful upward or downward trends over weeks or months.

Characteristics of Position Trading

Long Holding Periods: Typically from several weeks to a few months.

Lower Trading Frequency: Fewer trades with higher profit targets.

Macro-Focused Analysis: Emphasis on project fundamentals, market adoption, regulation, and sentiment.

Analytical Approach

Fundamental Analysis: Evaluating the project’s use case, tokenomics, developer activity, and community.

Technical Analysis: Using longer timeframes (daily, weekly charts) and patterns like triangles, breakouts, and Fibonacci cryptocurrency trading strategies retracements.

Sentiment Indicators: Monitoring social sentiment and institutional behavior in the crypto space.

Benefits of Position Trading

Reduced Stress: Less need for constant monitoring or reacting to short-term volatility.

Lower Fees: Fewer trades mean reduced cumulative transaction costs.

Compounding Growth: Profits from long upward trends can significantly outperform short-term gains.

Risks and Drawbacks

Prolonged Exposure: Markets can reverse, leading to drawn-out losses or missed opportunities elsewhere.

Patience Required: Holding through periods of consolidation or pullbacks requires mental resilience.

Dependence on Trend Continuation: Profits rely heavily on the assumption that the market will sustain its direction.

When to Use Position Trading

This strategy is best for traders who:

Have strong fundamental understanding of projects.

Prefer a less active trading lifestyle.

Are comfortable with market swings and long-term investment logic.

Conclusion

Position trading offers an alternative to fast-paced strategies by allowing traders to focus on the bigger picture. For patient and research-driven individuals, it provides a path to capitalizing on major crypto market trends without the stress of daily market noise.

0 notes

Link

#chartpatterns#FibonacciLevels#FibonacciRetracementTrading#GoldenRatio#MarketPrediction#marketvolatility#priceaction#ProfitTaking#riskmanagement#StockMarket#supportandresistance#technicalanalysis#TradeEntryPoints#TradingSignals#TradingStrategy#TrendReversal

0 notes

Text

XRP's Big Breakout Is Coming — Is Your Crypto Wallet Ready?

The cryptocurrency market never stays silent for too long — and XRP is the latest asset signaling a major move. After weeks of consolidation, XRP is building up energy that could soon explode into a significant rally.

Technical analysis based on the Elliott Wave Theory suggests that Wave 5 is approaching, potentially sending XRP’s price to an ambitious target of $5.85. As the opportunity heats up, smart investors are choosing reliable platforms like UPBonline to position themselves early and securely.

XRP's Long Consolidation: Calm Before the Storm

For months, XRP has been trading between a narrow range, frustrating traders who seek volatility. But consolidation periods are often precursors to large breakouts.

Key drivers behind XRP's sideways movement:

Regulatory uncertainties clouding the U.S. market

Ripple Labs' ongoing legal battles with the SEC

Broader crypto market hesitation in the face of macroeconomic factors

However, technical charts are now showing signs that the end of this consolidation is near, and a breakout could be imminent.

Why Wave 5 Could Be Historic for XRP

The Elliott Wave Theory is a classic method of predicting market cycles, and XRP’s current structure fits the textbook setup:

Wave 1: Initial rally

Wave 2: Corrective pullback

Wave 3: Strong surge

Wave 4: Complex correction (ongoing)

Wave 5: Final upward move — possibly the most aggressive

Analysts expect Wave 5 to push XRP toward $5.85, backed by technical indicators, Fibonacci levels, and XRP’s historical patterns.

As these signs align, investors preparing ahead with strong platforms like UPBonline could be better positioned to act quickly and securely when momentum shifts.

Technical Indicators Supporting a Breakout

Several bullish signals are flashing:

RSI levels are in oversold territory

MACD is forming a bullish crossover

Accumulation by whales is rising, indicating institutional interest

Fibonacci extensions point toward the $5.50 to $6.00 range

Moreover, XRP’s strong support around the $0.55 level has held firm, setting a foundation for an upward explosion.

With this setup, retail investors using traditional exchanges might face delays — but using agile, crypto-focused platforms like UPBonline ensures faster, smoother transactions.

Why UPBonline is the Right Choice for the Next Crypto Move

As XRP gears up for a possible surge, the importance of choosing the right trading and banking partner cannot be overstated. UPBonline offers a seamless platform for crypto banking, secure crypto payments, and instant XRP transactions.

Top reasons to choose UPBonline before the breakout:

Fast transaction speeds

High-security standards

Easy XRP management

Integrated crypto banking solutions

Professional-grade support for traders and investors

Instead of scrambling after the rally begins, UPBonline users are already positioned, ready to capitalize on XRP’s next big wave.

Conclusion: Prepare Early, Act Smart

XRP’s consolidation phase appears to be nearing its end. Technical patterns, market indicators, and broader sentiment suggest that Wave 5 could soon launch XRP toward $5.85.

In the fast-moving world of crypto, timing is everything. Choosing a powerful, reliable platform like UPBonline could make the difference between catching the breakout or missing the opportunity.

Are you ready to ride XRP’s Wave 5? Secure your position today with UPBonline and stay ahead of the market! 🚀

1 note

·

View note

Text

Gold Trading

Gold trading involves buying and selling gold with the aim of making a profit from price fluctuations. Gold is a popular asset due to its historical value, hedge against inflation, and safe-haven status during economic uncertainty. Here’s a breakdown of key aspects of gold trading:

involves buying and selling gold with the aim of making a profit from price fluctuations. Gold is a popular asset due to its historical value, hedge against inflation, and safe-haven status during economic uncertainty. Here’s a breakdown of key aspects of gold trading:

Gold trading is a solid choice—especially if you're looking for stability, a hedge against inflation, or a safe-haven asset during market uncertainty. It's less volatile than crypto but still offers solid opportunities for swing and short-term trades.

Here’s everything you need to know to get started with gold trading, step by step:

🪙 Why Trade Gold?

Gold (symbol: XAU) is one of the oldest and most traded commodities in the world. People trade it because:

It retains value over time

It performs well during economic crises

It reacts to macro events (inflation, interest rates, wars, USD strength)

📈 Ways to Trade Gold

1️⃣ Spot Gold (XAU/USD)

You're trading gold against the U.S. dollar.

Available on many forex and CFD platforms.

You don't own physical gold—just the price difference.

✅ Good for short-term traders and scalpers.

2️⃣ Gold ETFs (like GLD)

Traded like stocks on exchanges.

Follows the price of gold.

Easy for U.S. traders via brokers like TD Ameritrade, Robinhood, etc.

✅ Best for swing traders or investors who want gold exposure.

3️⃣ Gold Futures

Contracts to buy/sell gold at a future date.

Traded on CME (Chicago Mercantile Exchange).

High leverage = high risk.

✅ Ideal for experienced traders.

4️⃣ Gold Mining Stocks

Stocks of companies that mine gold (e.g., Barrick Gold, Newmont).

Move with gold, but also depend on company performance.

✅ Adds diversity, can offer dividends.

📊 Technical Analysis for Gold

Use the same tools as in stock/crypto trading:

best stock strategy

Support & resistance (gold respects technical zones well)

RSI (watch for overbought/oversold)

Moving Averages (EMA 50/200 for trends)

Fibonacci retracement (great for pullbacks)

🌍 What Moves Gold Prices?

Understanding gold’s macro drivers helps your timing:

USD strength/weakness (gold moves opposite of the dollar)

Inflation (gold is seen as a hedge)

Interest rates (higher rates = lower gold prices)

Geopolitical tension (war or instability pushes gold up)

🧠 Risk Management Tips

Gold may be stable, but it still moves ~$10–$30 per day.

Always use a stop-loss, especially when trading with leverage.

Risk only 1–2% per trade.

Don't hold overnight during key news events unless you're swing trading.

🧰 Tools for Gold Traders

TradingView – for charting XAU/USD or GLD

ForexFactory – for macroeconomic news

Kitco.com – live gold prices, news, and sentiment

🎯 Simple Gold Trading Strategy (Example)

Swing Trade Setup:

Wait for XAU/USD to pull back to a key support zone (e.g., 200 EMA)

Confirm with bullish candlestick pattern + RSI under 40

Target next resistance zone

Stop-loss just below swing low

✅ Risk/reward = at least 1:2

Gold trading involves buying and selling gold in various forms—such as physical bullion, ETFs (like GLD), futures, CFDs, and mining stocks—to capitalize on price fluctuations driven by factors like the US dollar's strength, interest rates, inflation, geopolitical risks, and central bank policies. Traders employ strategies like trend following, breakout trading, and hedging, often using platforms like best stock strategy or TradingView, while managing risks such as volatility, leverage, and liquidity constraints. The most active trading periods occur during the US/London market overlap and major economic announcements, making gold a popular choice for both short-term speculation and long-term wealth preservation.

0 notes

Text

Nifty 50, Sensex today: What to expect from Indian stock market in trade on April 9 ahead of RBI policy

The Indian stock market benchmark indices, Sensex and Nifty 50, are likely to open lower on Wednesday, influenced by negative global cues.

The trends on Gift Nifty also indicate a negative start for the Indian benchmark index. The Gift Nifty was trading around 22,442.50 level, a discount of 187.85 points from the Nifty futures’ previous close.

The Reserve Bank of India (RBI) will announce its monetary policy today. The RBI Governor Sanjay Malhotra-led Monetary Policy Committee (MPC) is expected to cut repo rate amid cooling inflation and slowing economic growth.

On Tuesday, the domestic equity market witnessed a sharp relief rally, with the benchmark Nifty 50 closing above 22,500 level.

The Sensex surged 1,089.18 points, or 1.49%, to close at 74,227.08, while the Nifty 50 settled 374.25 points, or 1.69%, higher at 22,535.85.

Here’s what to expect from Sensex, Nifty 50 and Bank Nifty today:

Sensex Prediction

Sensex bounced back sharply on Tuesday and rallied by 1,089 points, closing above the 74,200 level.

“Promising reversal formation and higher bottom formation on intraday charts suggesting pullback formation is likely to continue in the near future. For day traders now, 73,500 would be a key level to watch for Sensex; above this level, a pullback wave could move up to 75,000, with further upside potentially lifting the Sensex index to 75,200. Conversely, a dismissal of 73,500 could accelerate selling pressure. If this level is breached, Sensex could retest 73,000–72,800,” said Shrikant Chouhan, Head equity Research, Kotak Securities.

According to him, the current market texture is extremely volatile and uncertain; thus, a level-based trading strategy would be ideal for day traders.

Nifty OI Data

Nifty derivative data continues to reflect a cautious-to-bearish tone. Call writers have remained aggressive, outnumbering their put counterparts and adding to the negative bias. The 23,000 strike saw a massive call OI (Open Interest) buildup of 1.02 crore contracts, confirming its status as a formidable resistance level. On the flip side, solid put writing was visible at the 22,500 strike (67.90 lakh contracts), which indicates firm support at lower levels, said Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities.

Nifty 50 Prediction

Nifty 50 continued its follow-through upmove on April 8 and closed the day with handsome gains of 374 points.

“A reasonable positive candle was formed on the daily chart with long upper and lower shadow. Technically, this market action signals a formation of a high wave type candle pattern, which indicates ongoing high volatility in the market. The recent sharp opening downside gap of Monday has been challenged and has been filled partially. As per the gap theory, the said down gap could be considered as a bullish exhaustion gap and that is likely to be filled soon around 22,850 levels on the higher side,” said Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities.

Normally, bullish exhaustion gaps are more often associated with important bottom reversals. Immediate support is placed at 22,270, he added.

Om Mehra, Technical Research Analyst, SAMCO Securities noted that the Nifty 50 rebounded from the oversold zone — potentially a dead cat bounce, and has retraced to the 38.2% Fibonacci level, connecting the recent swing high and low.

“Nifty 50 remains below the 9, 20, and 50 EMAs (Exponential Moving Average) on the daily chart- a minor concern for a sustainable trend reversal. On a positive note, the hourly chart reflects a constructive development, with the previous resistance at 22,250 now acting as a support level, thereby strengthening the short-term bullish structure,” Mehra said.

The daily RSI and MACD are yet to cross above their respective averages, reflecting ongoing weakness and suggesting that market momentum is still in search of firm footing. A sustained move above 22,650 could pave the way for further upside in the upcoming session. The 50% Fibonacci retracement level at 22,800 remains a key resistance to watch, he added.

VLA Ambala, Co-Founder of Stock Market Today, highlighted that after the gap opening, the Nifty 50 moved in a 300-point range and formed a “high-wave doji” candlestick pattern on the daily chart.

“Amid these ongoing market developments, Nifty 50 can find support between 22,270 and 23,400 and meet resistance near 22,930 and 23,000,” said Ambala

Intensify Research Services is a professional stock consultive firm in Indore in share market latest news. We provide expert investment advice and guidance to individuals and High Net-Worth Individuals (HNIs), valuable trading tips and strategies for maximum profit. Visit us at Intensify Research Services to learn more.

#sharemarketing#stockinvestment#stock market#shareinvestor#sharetrader#sharemarket#stocks#sharetrading#share this post#investment

0 notes

Text

Gold Price Forecast: Navigating Market Trends and Potential Reversals

The gold market is currently experiencing fluctuations following a recent record high of $2,956. Analysts are closely monitoring key support and resistance levels, as predictions suggest a potential bearish retracement could be on the horizon. Investors are advised to stay alert to market signals that may indicate the next direction for gold prices. Key Takeaways - Gold reached a record high of $2,956 but has since pulled back. - Current support is seen at $2,833, with resistance around $2,930. - A drop below $2,894 may signal a bearish reversal. - Key targets for further declines are set around $2,820 to $2,813. Recent Market Trends Gold prices have shown significant volatility in recent weeks. After hitting a record high, the market has seen a pullback, with prices dropping below previous weekly lows. This behavior is typical in the early stages of a bearish retracement, where key support levels are tested. - Record High: $2,956 - Recent Low: $2,833 - Current Resistance: $2,930 The recent rally to $2,930 is viewed as a counter-trend movement, likely testing previous support levels as resistance. Analysts suggest that unless gold can sustain an advance above the record high, the market may continue to face downward pressure. Potential Bearish Reversal Signals Market indicators suggest that a bearish reversal could be imminent. The completion of a 78.6% retracement has raised concerns about the sustainability of the recent gains. A bearish engulfing pattern was noted at the end of last week, indicating a potential shift in market sentiment. - Key Support Levels: - $2,894: Critical level to watch; a drop below this may confirm bearish sentiment. - $2,820: Initial target for further declines, supported by Fibonacci retracement levels. Technical Analysis Insights Technical analysis reveals that the 20-Day moving average, which previously acted as support, has now become a resistance level. The market's behavior around this moving average will be crucial in determining the next steps for gold prices. - Resistance Levels: - 20-Day Moving Average - Rising Trendline If gold prices can break above these resistance levels, it may signal a continuation of the bullish trend. Conversely, failure to maintain support at $2,833 could lead to further declines, with targets set around $2,813 to $2,810. Conclusion As the gold market navigates these fluctuations, investors should remain vigilant. The potential for a bearish retracement looms, and understanding key support and resistance levels will be essential for making informed trading decisions. Keeping an eye on market indicators and economic events will provide further clarity on the direction of gold prices in the coming weeks. Sources - Gold Price Forecast: Rebounds but Bearish Retracement May Resume Below $2,894, FXEmpire. - Gold Price Forecast: Holds Near Highs but Faces Potential Bearish Reversal, FXEmpire. - Gold Price Forecast: Stalled at Resistance – Bearish Continuation Ahead?, FXEmpire. Read the full article

0 notes

Text

Top Strategies for Successful Swing Trading: Tips and Techniques

Swing trading is a popular trading strategy where traders aim to capitalize on price swings in the market. Unlike day trading, where positions are held for minutes or hours, swing trading involves holding positions for several days or weeks to take advantage of short- to medium-term trends. If you're looking to boost your swing trading game, understanding effective strategies and techniques is crucial. In this article, we’ll explore top strategies for successful swing trading that can enhance your chances of consistent profits.

1. Identify the Right Market Conditions

Before diving into swing trading, it’s essential to analyze the broader market conditions. Successful swing traders understand that market environments are ever-changing, and recognizing whether the market is trending or in a consolidation phase is key. Trending markets provide the best opportunities for swing trading, while sideways markets can be more challenging.

Using technical analysis tools such as moving averages and trendlines can help you identify the market's current direction. For instance, if the price is above a long-term moving average, the market is likely in an uptrend, presenting ideal conditions for swing trades focused on buying.

2. Utilize Technical Indicators

Swing traders rely heavily on technical indicators to predict price movements and identify entry and exit points. Here are a few key technical indicators every swing trader should consider:

Relative Strength Index (RSI): RSI helps identify overbought or oversold conditions. A value above 70 indicates overbought, while below 30 signals oversold. Swing traders can use this to find potential reversals.

Moving Averages (MA): Moving averages smooth out price data, helping to identify the overall trend. The simple moving average (SMA) and exponential moving average (EMA) are commonly used to assess the market’s direction.

MACD (Moving Average Convergence Divergence): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. The MACD can signal potential buy or sell opportunities when the moving averages cross.

3. Follow the Trend with Pullbacks

One of the most effective swing trading strategies is to follow the trend and wait for pullbacks. In a trending market, price often moves in waves. After a price advance, a pullback (a brief drop) often occurs before the trend resumes. Swing traders can take advantage of these pullbacks to enter trades at more favorable prices.

For example, during an uptrend, traders often wait for a brief pullback to a support level or a moving average before entering a long position. This strategy helps minimize risk and ensures that traders enter the market at optimal times.

4. Set Clear Entry and Exit Points

One of the key aspects of successful swing trading is setting clear entry and exit points. Without a predetermined plan, traders may end up chasing the market, leading to poor decision-making and potential losses.

Entry Points: Use technical indicators, chart patterns, or trendlines to determine your entry point. Look for signals like a break of resistance or a bounce off support.

Exit Points: Setting profit targets and stop losses is crucial to managing risk. Determine an exit strategy based on support and resistance levels or key Fibonacci retracement levels.

5. Risk Management is Key

Risk management is essential for any successful trading strategy. As a swing trader, you should only risk a small portion of your account on each trade—typically no more than 1-2%. This helps protect your capital in case of unexpected market movements.

Utilize stop-loss orders to limit your losses. A well-placed stop-loss can automatically exit your position if the market moves against you, preventing significant losses. Similarly, use trailing stops to lock in profits as the trade moves in your favor.

6. Keep Emotions in Check

Swing trading can be emotional, especially when the market experiences large swings. To be successful, traders need to remain calm and follow their strategy without letting fear or greed influence their decisions. Developing a disciplined trading routine and sticking to your plan is essential for long-term success.

Conclusion

Swing trading can be highly profitable when executed with the right strategies and techniques. By identifying favorable market conditions, utilizing technical indicators, following trends with pullbacks, and practicing effective risk management, swing traders can increase their chances of success. Always remember that consistency and discipline are key to becoming a successful swing trader. If you’re looking to elevate your swing trading skills, FuturesElite offers comprehensive resources and expert advice to help you refine your strategies and take your trading to the next level.

0 notes

Text

An In-Depth Analysis of Bitcoin's Potential Direction for the Week of January 27–31, 2025

Bitcoin (BTC), the leading cryptocurrency, finds itself at a pivotal juncture as it navigates through the critical week of January 27–31, 2025. With a mix of bullish momentum, technical uncertainties, and macroeconomic influences at play, traders and investors are closely watching key levels to anticipate the cryptocurrency's next move. This essay provides an in-depth analysis of the factors influencing Bitcoin's potential direction for the week, grounded in technical, on-chain, and market sentiment indicators.

Technical Resistance and Support Levels

Bitcoin's price action this week will revolve around several well-defined technical zones that could either catalyze a rally or trigger a deeper correction. The immediate resistance lies at $105,000, a critical psychological barrier that aligns with historical patterns of heightened trader activity. A sustained breakout above this level could ignite a rally toward $120,000, especially if institutional buying intensifies.

On the downside, Bitcoin faces support zones at $100,000 and $94,665. These levels have acted as safety nets during recent price volatility. Should Bitcoin fail to hold above $100,000, selling pressure could accelerate, testing the $92,000–$95,000 range. A breach below these supports may open the door for a deeper correction to $87,000, in line with Elliott Wave analysis.

Mixed On-Chain and Technical Signals

Bitcoin's technical and on-chain indicators paint a complex picture of the market's sentiment and momentum. On the bullish side, moving averages and the Relative Strength Index (RSI) at 66.33 indicate ongoing buying momentum. The RSI's proximity to the overbought zone suggests that while there may be short-term corrections, the broader bullish trend remains intact. Similarly, the Stochastic Oscillator, despite being in the overbought zone, signals potential upward continuation before a more substantial reversal.

Conversely, there are cautionary signs. CryptoQuant's Bitcoin Cycle Indicators (IBCI) point to a "distribution phase," which has historically coincided with market peaks. This raises the risk of a near-term pullback. Elliott Wave analysts from LiteFinance predict a possible decline to $89,107, citing corrective wave patterns, further emphasizing the need for vigilance.

Market Sentiment and Liquidation Events

Market sentiment remains volatile, as reflected in over $36 million in liquidations in the past 24 hours. The balanced ratio of long and short positions underscores trader uncertainty about Bitcoin's short-term trajectory. However, on-chain metrics provide a glimmer of hope. The Market Value to Realized Value (MVRV) ratio for short-term holders, currently at 0.96, suggests Bitcoin is undervalued. This could fuel accumulation among investors, potentially stabilizing prices.

Macro and Institutional Catalysts

Institutional involvement continues to play a decisive role in Bitcoin's price dynamics. Significant inflows into Bitcoin ETFs, such as the $475 million recorded in a single day, highlight growing institutional interest. Additionally, the influx of stablecoin deposits into exchanges signals preparation for potential buy orders, which could provide a buffer against downside pressure.

Seasonal trends, including the Spring Festival effect, have historically been bullish for Bitcoin as retail participation surges during this period. If this trend holds, it may contribute to upward momentum, counteracting bearish signals from technical and on-chain analyses.

Recent Price Action and Key Levels

Bitcoin experienced a sharp sell-off on January 27, briefly dropping below $100,000 for the first time in weeks. Currently, the price is testing the 50-day EMA and the 50% Fibonacci retracement level around $95,000, which historically act as strong support levels. A successful rebound from these levels could reignite bullish momentum, targeting $105,000 and beyond.

Conversely, a failure to hold these supports may trigger a more significant downturn, aligning with Elliott Wave forecasts and distribution phase warnings.

Predicted Direction for the Week

Bitcoin's performance this week is likely to be characterized by short-term volatility, as it oscillates between key support and resistance levels. Several scenarios could unfold:

Bullish Case: A rebound from $95,000–$100,000 could validate upward targets of $105,000 and potentially $120,000, driven by institutional demand and retail participation.

Bearish Case: A breakdown below $95,000 may lead to a retest of $87,000, in line with corrective patterns predicted by Elliott Wave analysis.

Neutral Scenario: Prolonged consolidation within the $95,000–$105,000 range may dominate if neither buyers nor sellers gain decisive control.

Key Levels to Watch

SupportResistance $95,000 (50-day EMA) $105,000 (immediate) $92,000–$94,665 $112,605 (bullish breakout) $87,000 (long-term) $120,000 (psychological)

Conclusion

Bitcoin's direction for the week of January 27–31, 2025, hinges on its ability to navigate critical technical levels amid conflicting signals. While the broader bullish trend appears intact, supported by institutional demand and seasonal factors, bearish warnings from on-chain metrics and technical analyses warrant caution. Traders should prepare for heightened volatility and closely monitor the $95,000–$105,000 range as decisive price thresholds.

By balancing risk and opportunity, market participants can capitalize on potential breakouts while safeguarding against downside risks. Ultimately, Bitcoin's performance this week will reflect the interplay of technical signals, market sentiment, and macroeconomic forces, setting the stage for its next major move.

#Bitcoin Analysis#Cryptocurrency Market#Price Prediction#Technical Analysis#Fundamental Analysis#Market Trends#Bitcoin Price#Crypto News#Weekly Analysis#Crypto Market Outlook

0 notes

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw ringing in the New Year and ringing out a fabulous 2024, that the week showed some disappointment in equity markets year end and an early year rebound. Elsewhere looked for Gold ($GLD) to continue to consolidate the major move higher while Crude Oil ($USO) rose in consolidation in the lower end of a broad range. The US Dollar Index ($DXY) looked to continue the breakout higher while US Treasuries ($TLT) consolidated at 14 month lows.

The Shanghai Composite ($ASHR) looked to reverse its uptrend with a break lower while Emerging Markets ($EEM) were reversing their uptrend. The Volatility Index ($VXX) looked to remain low making the path easier for equity markets to the upside. The charts of the $SPY and $QQQ continued to look strong on the longer timeframe. On the shorter timeframe both looked a little weaker but finding support. The $IWM was recovering, and so far, maintaining the uptrend.

The week played out with Gold moving higher in consolidation all week while Crude Oil found some strength Friday and moved to 3 month highs. The US Dollar continued to move up to a 26 month high while Treasuries resumed the move lower. The Shanghai Composite continued its short term move lower while Emerging Markets sank to a 5 month low.

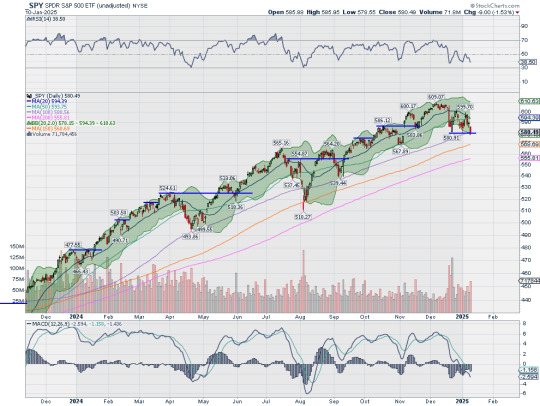

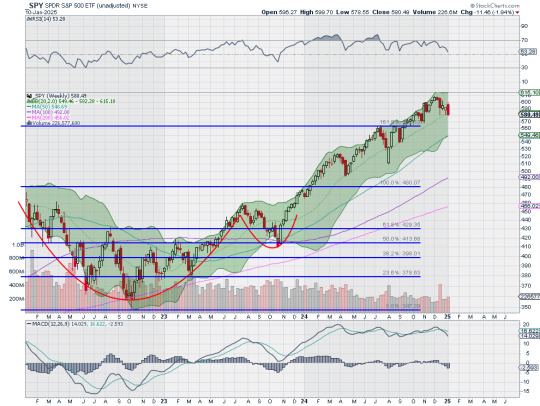

Volatility ticked higher on the week testing the 20s. This put a damper on the beginning of the year bounce in equities and they fell back. This resulted in the SPY dropping back to the November election gap, the QQQ retesting a major Fibonacci extension and the IWM nearly tagging its 200 day SMA for the first time in 13 months. What does this mean for the coming week? Let’s look at some charts.

The SPY came into the week bouncing off support at the December low on the daily chart. It continued higher Monday but could not make a higher high and fell back the rest of the week. It ended Friday at a 2 month low at the 100 day SMA and into the Election gap. The Bollinger Bands® have shifted lower on the daily chart. The RSI is dipping into bearish territory and making lower highs while the MACD is negative and falling.

The weekly chart ended with a bearish engulfing candle at the 20 week SMA. This is the first touch at the 20 week SMA in 4 months. The RSI is rolling lower toward the midline in the bullish zone with the MACD crossed down and falling but positive. There is support lower at 580 and 574.50 then 571.50 and 565.50 before 561.50 and 556.50. Resistance higher is found at 585 and 590 then 593 and 600 before 604 and 609. Pullback in Uptrend.

Heading into the January options expiry and the start of earnings season, equity markets showed some short term weakness. Elsewhere look for Gold to continue its rise in consolidation while Crude Oil consolidates in the upper half of a broad range. The US Dollar Index continues to drift to the upside while US Treasuries resume their downtrend. The Shanghai Composite looks to continue the short term move lower while Emerging Markets consolidate continue their downward reversal.

The Volatility Index looks to remain on the edge of low to slightly elevated making the path easier for equity markets to the downside. Their charts are starting to show some cracks on the weekly chart, but with the QQQ remaining strong, on the longer timeframe. On the shorter timeframe the SPY, the QQQ and the IWM all are making lower lows and looking weaking. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview January 10, 2025

1 note

·

View note